Despite all the financial headaches of Golden State life, it’s noteworthy that Californians remain better at making timely payments than the nation.

My trusty spreadsheet reviewed the latest consumer bill-payment data from the Federal Reserve Bank of New York. The research, drawn from a sampling of individual credit histories, examines debt levels and payments from 2003 to the second quarter of 2025 in 11 big states – including California – and the nation.

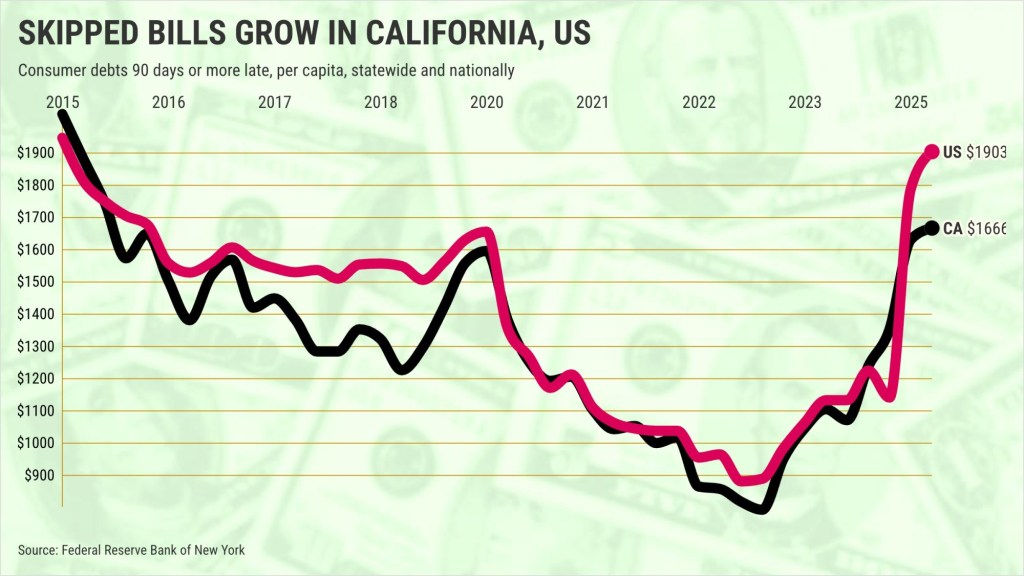

Let’s look at the size of the past-due bills for a typical Californian. Debts that are past due 90 days or more equaled $1,666 per capita in the second quarter.

That’s the highest amount of delinquent payments since the third quarter of 2015. It’s also more than double the decade’s low of $792 in 2023’s first quarter.

And while those are worrisome trends, let me note California’s delinquencies are nowhere near the $10,477 high set in the second quarter of 2009, during the Great Recession.

The patterns are similar elsewhere. Bill-paying challenges are rising from lows fueled by pandemic-era stimulus cash and loan forbearances that are now gone.

Look at the typical American who was late on $1,903 worth of bills, per capita, in the second quarter. That’s 14% more than California, usually known for financial stresses larger than the nation.

It’s also the biggest unpaid U.S. consumer debt since the start of 2015 and double the low of $880 in 2023’s first quarter.

Again, it’s just an uptick worth watching. Skipped bills remain far from the record U.S. high – $4,352 in 2010’s first quarter.

Competitive numbers

Slower payments are a common theme across the nation in 2025.

The end of deferred student loan payments is a big reason. Renewed repayment demands are a challenge for educational borrowers.

Other bills become struggles, too, as the economy cools, inflation still boosts expenses, and high interest rates amplify the pain of any borrowings.

Look at delinquency in California’s big economic rivals.

In Texas, slow payments are $2,356 per capita. That’s 41% more than California and Texas’s all-time high.

And in Florida, there’s $2,561 in late bills per capita – 54% above the Golden State and up 155% from the $1,003 low in 2023’s first quarter.

A different look

Contemplate these skipped payments as a share of total debts to see below-average tardiness.

California’s late bills equaled 1.9% of everything owed in the second quarter. That’s well below the 3.6% average delinquency over 23 years.

Contrast that to the 3% of debts that are late nationwide. Still, the typical American is missing a few due dates that the 3.7% U.S. average since 2003.

Texas has a 3.9% late payment rate, equal to its average. And Florida? 4.1% late pays vs. a 6.3% average.

Big debts

Californians owe lots of money, thanks to big loans needed to buy expensive homes.

Yet borrowing is out of favor recently – statewide and nationally. Some folks see fewer new debts as a sign of financial discipline. Others think the frugality signals economic skittishness.

Statewide, there were a total of $87,660 per capita in debts this spring – up 1.6% in a year. But it’s roughly half of California’s 3.1% annual growth over 23 years.

Contrast that to the typical American, who has only $63,020 in debt per capita. That’s up 1.9% in a year vs. the 3.3% average.

Texas? $59,940, up 4.1% in a year, on par with its historic pace. Florida? $62,000, up 2.9% – below its 3.6% average.

Second opinion

Californians are also above average when it comes to another type of bill-paying scorecard – credit scores.

Peek at two recent state-by-state measurements of creditworthiness – FICO and VantageScore. The typical Golden Stater had an average 715 score.

This is the 25th best among the states and tops the 709 national score. The state and U.S. scores are considered mid-range “good” bill-paying grades on a scale that runs to the “perfect” 850.

The best credit scores? Minnesota (735), New Hampshire (732), Vermont (731), Wisconsin (730), and Washington state (729).

The lowest? Mississippi (675), Louisiana (683), Alabama (686), Texas (688), and Arkansas and Georgia at 689. And Florida was No. 37 at 702.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com

Originally Published:

<